Insurance IP Bulletin

An

Information Bulletin on Intellectual Property

activities in the insurance

industry

A

Publication of - Tom Bakos Consulting,

Inc. and Markets, Patents and

Alliances, LLC

|

June 15, 2006

VOL: 2006.3

|

Basic Ed.

Insurance is a Process of

Processes - Contingent

Events

Our mission has been to provide useful information on how innovation in the

insurance industry can be protected with patents, principally, but also with

trademarks and copyright. The presumption has been that our readers were already

fairly familiar with the business of insurance. So, we have focused on providing

education and insight into IP protection processes.

In order to understand innovation and invention in the insurance business, it

is very helpful to understand insurance. We find that the presumption that our

readers are well versed in insurance principles and only need help understanding

the IP protection side is not 100% correct. Many have a greater understanding of

the patent processes than they do of the insuring processes which can present

just as great a difficulty in identifying invention as the other way around. So,

we will try to address this void by providing in this Basic Ed. column some

basics on insurance. We hope that it will be informative to all of our readers.

The first thing to

recognize is that insurance is a process – actually, it is a process

of processes. It is this fact that makes inventive insurance processes, or

business methods, patentable. As patent savvy people know, there are four

categories of patentable subject matter: articles of manufacture, compositions

of matter, machines, and processes. Insurance business methods fall primarily

into the process category, and, to the extent computers are involved, the

machine category.

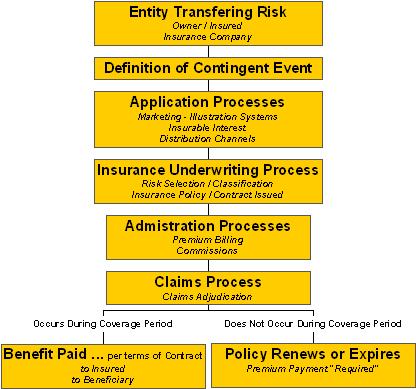

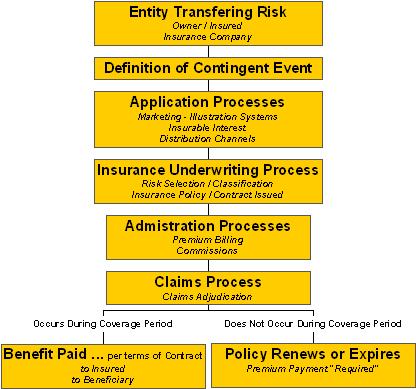

One schematic of the various processes making up the overall insurance

process is shown in the chart.

This schematic splits the overall insurance process into eight more

elementary processes. Insurance innovators seek solutions, or better solutions,

to problems in these elementary processes.

The most essential process is the Definition of Contingent Event

process since this process identifies what is being insured and effects in some

way all of the others. We are, therefore, going to address what a contingent

event is first and its relationship to risk.

Generally, risk means an exposure to loss or damage as a result of the

possible occurrence of a contingent event. A contingent event is an event

which is uncertain with respect to its occurrence, timing, or

severity. Typically, loss or damage is expressed in terms of dollars.

For example, driving exposes you to the risk that you may crash your

automobile or be involved in a crash. A crash may or may not happen (occurrence)

and its severity can vary - fender bender vs. total destruction. Winning the

lottery is also a contingent event (assuming you bought a ticket) with respect

to its occurrence. Living exposes you to death at some point in your life. We

are not immortal so death is certain – only its timing is usually uncertain.

That is, we may live to a ripe old age, die earlier than old age as a result of

sickness, or suddenly by accident.

Winning the lottery would be a good thing so, severity, may not be the most

appropriate word to use to describe your lottery winnings but the amount of your

winnings will depend upon how many others also chose the same winning numbers.

Your death is the loss of your life and your life has a value which may be

quantified in terms of future earnings lost. A death may also create a financial

strain as a result of the inability it causes to satisfy some expected promise

of performance. The need to repair or replace your car following a crash

quantifies the financial consequences of an automobile accident. Similarly, any

property insurance can be quantified in terms of the repair or replacement

cost.

Insurable events are a sub-set of contingent events. Insurable events are

contingent events which result in some adverse financial consequence to someone

and have a relatively low probability of occurring. Insurance is, essentially, a

way to manage the financial consequences of risk.

The basic insurance process transfers the financial consequences of risk from

one entity to another for a premium. Insurance is evidenced by a legal contract

– the insurance policy.

Contingent events that occur with relatively high frequency and for which

there is little uncertainty with respect to their occurrence or timing are not

insurable because there are better ways to address the financial consequences.

Pregnancy, for example, though it has financial consequences, is not really an

insurable event because to a certain extent it can be planned and budgeted for.

Medical complications resulting from pregnancy, however, are uncertain and can

be considered insurable events.

Equity in insurance requires that individuals who pay a premium for their

insurance be grouped or pooled with other individuals who are exposed to the

same risks and have the same or, at least, a similar expectation of loss

associated with the occurrence of the insured contingent event.

Equity in insurance is a fairness issue but it also has a practical side. The

premium charged for insurance is a kind of pooling cost that all members of a

risk class agree to pay into the risk class pool in order to receive a larger

benefit from the risk class if the insured contingent event happens to them. An

individual who feels that they are being charged too much relative to the others

in the pool for the risk they are transferring to the pool, will tend to not

join. Those who feel their risk is greater than what is being charged to join

will join the pool more readily. In order to maintain equity, the insurance

company uses a risk selection process called underwriting to select and

classify risk in order to determine an appropriate premium to charge for the

risk transfer process.

Contingent events that occur very infrequently and that have huge financial

consequences may be uninsurable for practical reasons. That is, there is either

no entity willing or able to accept through an insurance process such a

financial consequence or no one would willing to pay the premium required for an

event with such a low frequency – even though its occurrence would be

devastating.

Insurance is a process of processes. An early step in the process is defining

the contingent event that is being insured against. Contingent events are

considered to be insurable if the frequency is relatively low, the financial

impact is relatively high (but not too high) and the occurrence is largely

outside of the control of the insured. Improvements in the process of defining

insurable contingent events is an important area of innovation in the insurance

industry, and can lead to patentable inventions.