|

Insurance IP Bulletin

An

Information Bulletin on Intellectual Property

activities in the insurance

industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

August 15, 2006 VOL: 2006.4 | ||

Basic Ed.

Is it Insurance?

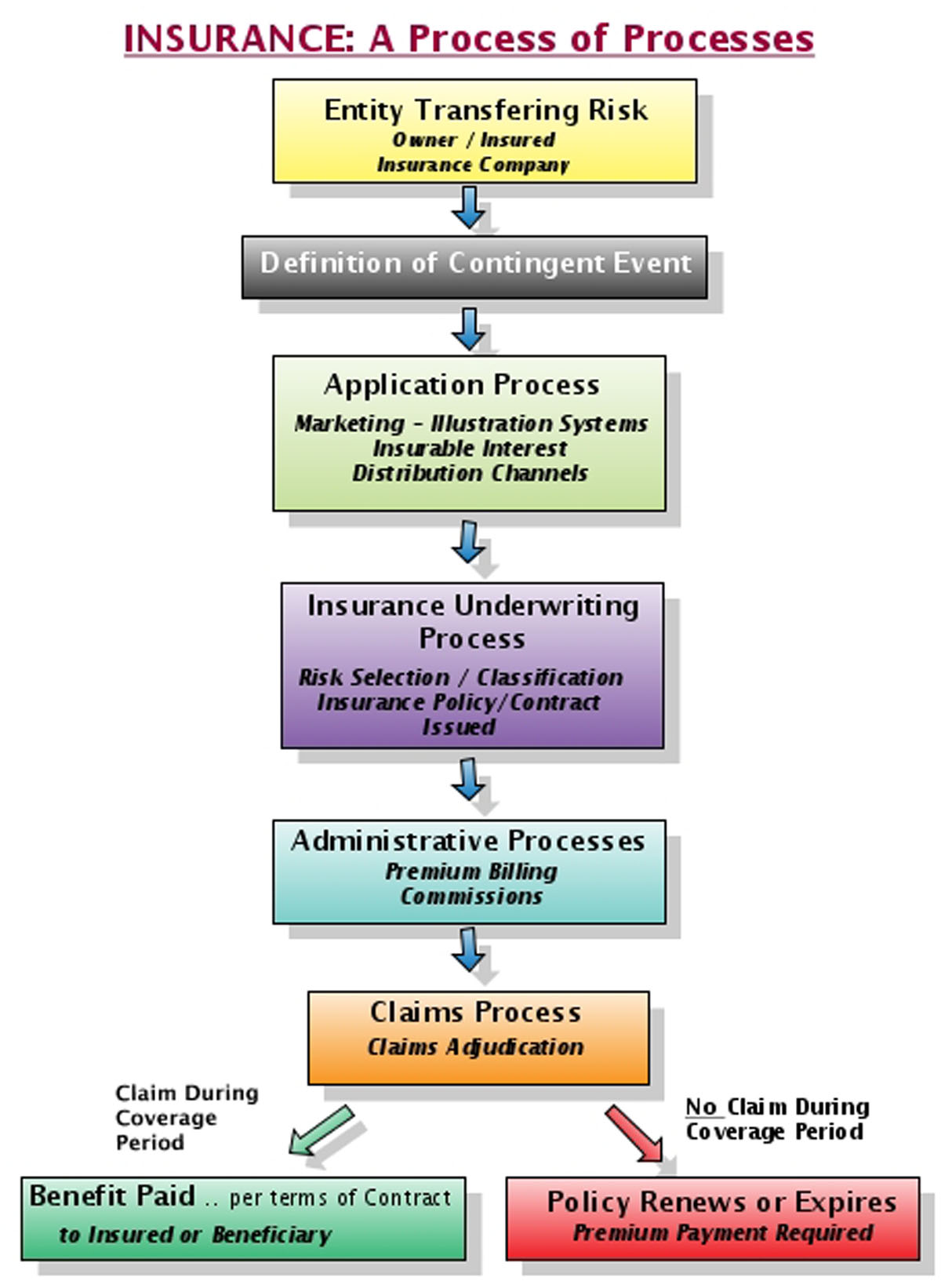

The chart from the last (June, 2006) issue which portrayed insurance as a process of processes is updated to the right. Invention in insurance addresses processes because, basically, that’s what insurance is. Some of these process inventions may enable new forms or types of insurance.

For

example, let’s say an automobile insurer through one of its inventive employees

comes up with a method to encourage people to buy and keep buying automobile

insurance from that auto insurer. The method involves putting insureds who

pay their premiums on time into a special pool of insureds who are eligible

annually to win a free car through some random selection process. The method is

made more complicated by providing additional credits (and, therefore, a higher

probability of winning) if policyholders satisfy certain conditions related to

policy duration, driving record, claims experience, etc. Policyholders are also

given the option to elect a premium reduction in lieu of participating in the

car giveaway.

Is that insurance – or is it a lottery?

Another example - Say an airline decides to offer, for a fee or premium, the opportunity for members of the frequent flyers program who die to transfer the miles in their account to a beneficiary. Is that life insurance – or is it merely a refinement in a frequent flyer program?

If an insurance invention amounts to a refinement in an underwriting or claims process, for example, which is intended to be applied to well recognized types of insurance, the question asked in the title never comes up. But, if a new insurance process, in effect, defines a new type of insurance (as in the made-up examples above), there are practical issues that must be resolved before such a product can be brought to market in the highly regulated insurance industry. These issues should be in the mind of the inventor early on.

The USPTO may classify claims in class 705/004 (i.e. insurance inventions) as "…being a computer implemented system or method for writing an insurance policy .." but the regulating agencies that really matter are the state insurance departments.

Embedded somewhere in the law of each State in the US are sections which define the Kinds of Insurance Authorized. A typical example of a state which defines the authorized forms of insurance all in one place is North Carolina in § 58-7-15. Other states may spread the definition of what types of insurance are authorized under the types of insurance companies that are defined in their law. So, for example, property & casualty type coverages may be defined in a section that defines General P&C companies.

The types of insurance authorized fall into common categories of insurance which most people are familiar with: life insurance, annuities, accident & health, fire, property, animal, collision, personal injury liability, etc. There are 22 general categories of insurance allowed in the North Carolina law. Insurance regulation tends to be reactive but there is some provision in the law for innovation. Many inventors, after they peruse the first 21 sections and find no hits, will be left with the catch-all, Miscellaneous Insurance – which in North Carolina is defined as: "meaning insurance against any other casualty authorized by the charter of the company, not included in subdivisions (1) to (21) of this section, which is a proper subject of insurance".

However, even if an inventor manages to find a fit under insurance law and regulation for a product type, an invention which modifies or, the inventor thinks, improves an essential process which regulators have reacted to with some sensitivity in the past (e.g., benefit determination, commission payment, or underwriting classification) may run up against other hurdles that will get in the way of speedy regulatory policy form approval.

The bottom line is that invention in insurance may create just as many problems as it solves. Insurance inventors need to consider not only the social, psychological, and market challenges that invention creates but also the legal challenges that exist in a highly regulated industry.