| Insurance IP

Bulletin

An Information Bulletin on

Intellectual Property activities in the insurance

industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

June 15, 2007 VOL: 2007.3 |

||

| Adobe pdf version | Give us FEEDBACK | ADD ME to e-mail Distribution |

| Printer Friendly version | Ask a QUESTION | REMOVE ME from e-mail Distribution |

| Publisher Contacts

Tom Bakos Consulting, Inc.

Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com

Effect of KSR v. Teleflex U.S. Supreme Court Decision on Business method Patents Question: I heard that there was a recent U.S. Supreme Court decision that may make it harder to get a patent, especially a business method patent. Do I need to worry about this?Disclaimer:The answer below is a discussion of typical

practices and is not to be construed as legal advice of any kind. Readers are

encouraged to consult with qualified counsel to answer their personal legal

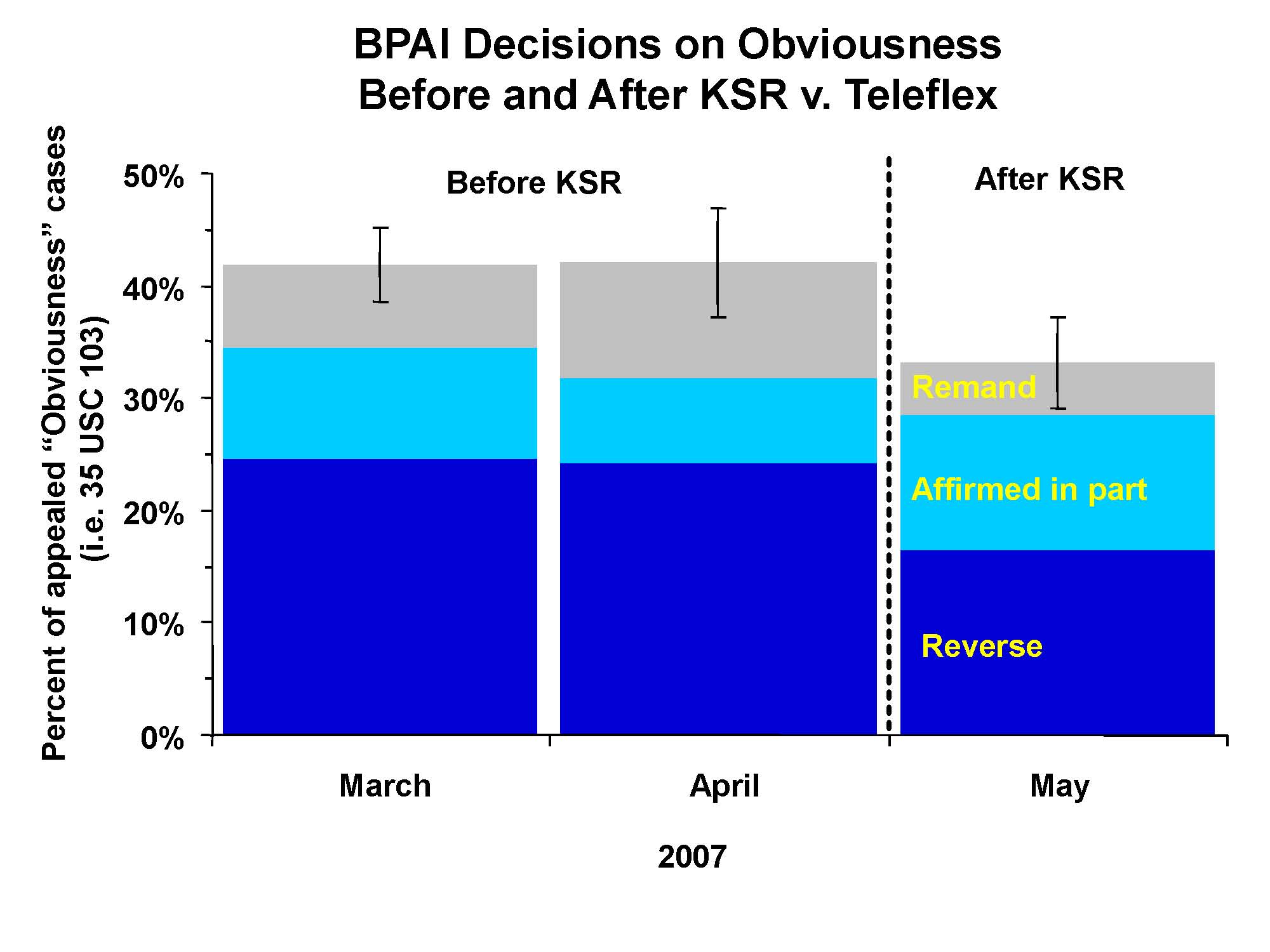

questions. Answer: Yes and No. Business method patents are still being granted, but you need to take into account the creativity and common sense of persons of ordinary skill in the art if you want to show that your invention is not obvious. Detais: The recent US Supreme Court decision KSR Int’l v. Teleflex Inc. (decided April 30, 2007) broadened the definition of “obvious” to include what would have been obvious to a person of “ordinary creativity” and “common sense” in the art of a given invention. Prior to this, a patent examiner could only take into account what was explicitly or inherently taught or suggested in the prior art to show that an invention was obvious. This decision sent shock waves through the patent community. It seemed to indicate that all a patent examiner had to do to declare an invention obvious was to say “well, anyone with ordinary creativity or common sense could have come up with this”. That would have been a very difficult argument to counter. That’s not the way it’s playing out at the patent office, however. The Board of Patent Appeals and Interferences, the highest decision making body at the USPTO, is still requiring that any assertions made by examiners be backed up with facts. As a consequence, there has been some drop in the rate that the Board is reversing the obviousness rejections of examiners, but they sky certainly isn’t falling. The graph below shows how the decisions of the Board have been affected by KSR. The average rate of examiner reversals, affirmed in parts, and remands are shown for the two months before KSR (March - April 2007), and the one month after KSR (May 2007). Only obviousness cases are shown. There are about 500 cases in total represented. A “reverse” means that the Board overturned the examiner and the applicant got all the claims they asked for. An “affirmed in part” means that that the Board agreed with the examiner on some claims but disagreed on others. The applicant still gets a patent, but not on everything he or she wanted. A remand means that the examiner still has more work to do before the case can be decided by the Board. ”Remand” also includes cases where the Board introduced new grounds for rejection. A new ground for rejection means that the applicant still has more work to do if he or she wants a patent. In the cases not shown, the Board agreed with the examiner (examiner “affirmed”). This means that the applicant won’t get a patent unless the applicant appeals the Board’s decision to the Court of Appeals for the Federal Circuit.

There certainly was a drop in the number of decisions in favor of the inventor after KSR. It by no means fell to zero, however. In fact, as the error bars indicate, the drop could have been due to normal month to month variations. Nonetheless, the tone of the decisions has changed. About one half of the decisions in May cite KSR whether or not the Board agreed with the examiner. The Board is taking into account “normal creativity” and “common sense”. Sometimes this works in favor of the examiner, but sometimes it does not. If the examiner uses particularly strained logic in an attempt to show that an invention would have been obvious, the board can overturn the examiner by saying that their rationale goes against common sense. Either way, the factors of normal creativity and common sense are now clearly part of the argument for or against obviousness and must be taken into account. As far as whether or not KSR will have an undue impact on business method patents, it’s still too early to say from a statistical standpoint. We’d like to point out, however, that one of the cases in May where the Board reversed the examiner and allowed the claims was for a business method patent application on a new financial services invention. The patent application is Crawford et al., “Dynamic Credit Management”, US 2003-0083984 A1. Readers can read the Board’s decision here. The Board cited KSR, but pointed out that the only way the examiner could have used the prior art to come up with the applicant’s invention was to use the applicant’s disclosure as a template. This is a clear case of hindsight. Whatever the impact KSR might have on business method patents as a whole, therefore, it certainly has not rendered all of them invalid. The US Supreme Court Case of KSR Int’l v. Teleflex

Inc., emphasized that the creativity and common sense of a person of

ordinary skill in the art can be taken into account to show that an

invention is obvious. Despite the fears of some, however, this has

not suddenly made all inventions obvious. So far, the decisions of

the Board of Appeals and Interferences at the USPTO in favor of applicants

has dropped somewhat, but the rate is still within the normal month to

month fluctuations. Even business method patents on financial

service inventions have been allowed despite the KSR factors. These

factors must be taken into account in the future, but it is still possible

to show inventions are not obvious over an examiner’s rejection. The Patent Reform Act of 2007 essentially replaces the Patent Reform Act of 2005 which died with the 109th Congress. This new, very similar legislation was introduced on April 18, 2007 in the 110th Congress. The House and Senate versions are virtually identical. Among the changes these bills are designed to make are the following:

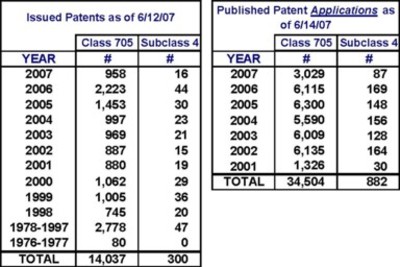

An Update on Current Patent Activity The table below provides the latest statistics in overall class 705

and subclass 4. The data shows issued patents and published patent

applications for this class and subclass.

Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION. Subclass 4 is used to identify claims in class 705 which are related to: Insurance (e.g., computer implemented system or method for writing insurance policy, processing insurance claim, etc.). Issued

Patents A total of 16 patents have been issued in the first half of 2007 (through June 12, 2007) – 7 during the period mid-April to mid-June 2007. Patents are categorized based on their claims. Some of these newly issued patents, therefore, may have only a slight link to insurance based on only one or a small number of the claims therein. The Resources section provides a link to a detailed list of these newly issued patents. Published Patent

Applications A total of 87 patent applications (31 in the last two months) have been published during the period mid-April to mid-June 2007 indicating continued patent activity in class 705/4. The Resources section provides a link to a detailed list of these newly published patent applications. Again, a reminder - Patent applications have been published 18

months after their filing date only since March 15, 2001. Therefore, there are many pending

applications that are not yet published. A conservative assumption would be

that there are, currently, about 200 new patent applications filed every

18 months in class 705/4. The published patent applications included in the table above are not reduced when applications are issued as patents, rejected, or abandoned. Therefore, the table only gives an indication of the number of patent applications currently pending. Resources Recently published issued U.S. Patents and U.S. Patent Applications with claims in class 705/4. The following are links to web sites which contain information helpful to understanding intellectual property. United States Patent and Trademark Office (USPTO) : Homepage - http://www.uspto.gov/ United States Patent and Trademark Office (USPTO) : Patent Application Information Retrieval - http://portal.uspto.gov/external/portal/pair Free Patents Online -

http://www.freepatentsonline.com/ Patent Law and Regulation - http://www.uspto.gov/web/patents/legis.htm Here is how to call the USPTO Inventors Assistance Center:

Mark Nowotarski - Patent Agent services – http://www.marketsandpatents.com/ Tom Bakos, FSA, MAAA - Actuarial services – http://www.BakosEnterprises.com |

In this issue’s feature article, Practical Patenting in the Financial Services Industries, we remind our readers of the basic right granted to an inventor by a patent and discuss some of the practical implications of that right. In our Patent Q/A we discuss the impact of the recent US Supreme Court decision, KSR v. Teleflex, on business method patents. Note also that the Patent Reform Act of 2007 has been introduced into the 110th Congress replacing, in effect, the 2005 version of this bill that died with the 109th Congress. These legislative changes are intended to improve the patenting system in the U.S. The Statistics section updates the current status of issued US patents and published patent applications in the insurance class (i.e. 705/4). We also provide a link to the Insurance IP Supplement with more detailed information on recently published patent applications and issued patents.

Our mission is to provide our readers with useful information on how intellectual property in the insurance industry can be and is being protected – primarily through the use of patents. We will provide a forum in which insurance IP leaders can share the challenges they have faced and the solutions they have developed for incorporating patents into their corporate culture. Please use the FEEDBACK link above to provide us with your comments or suggestions. Use QUESTIONS for any inquiries. To be added to the Insurance IP Bulletin e-mail distribution list, click on ADD ME. To be removed from our distribution list, click on REMOVE ME.

Thanks, FEATURE ARTICLE Practical

Patenting in the Financial Services

Industries Innovation in the insurance and broader financial services areas usually results in new and improved business methods which result in business method patents if the inventors value their intellectual property enough to protect it with a patent. The basic right granted by a patent is the right to exclude others from making, using, or selling your invention without your approval. Therefore, one would usually only seek patent protection if that was what one wanted to do. Patents have a well recognized importance in many of industries and are becoming more important in the financial services industries. But, occasionally, in the financial services industries one can still find a disbelief in the value of patents or a lack of understanding about patents or lack of skill in their construction. In addition, the rise in business method patents, that is patents not in the traditional science fields ordinarily associated with invention, has not been matched by a corresponding increase in the PTO’s expertise in the new areas of art covered by these inventions. As a result, applicants are experiencing greater delays in the examination process and a greater likelihood that a patent, if issued at all, may not be as comprehensive, as clear, or as valid as intended. We can look at this from two different points of view. You

Have a Patent --- Now What? The answer would be that you got a patent because you intend to enforce it. Enforcing your patent rights is your responsibility. There are no patent police. One of the first things you would need to do in answer to the “now what” question is notify anyone and everyone who might be involved in your area of art and, therefore, might have an interest in your business method process, that you have a patented invention. Your responsibility to enforce your patent is not matched by an obligation of everyone else to make themselves aware of your patent rights. You can provide this notification by indicating in your marketing or sales materials that the products you offer that utilize the patented technology have a patent, indicating the number of the patent. The object of getting a patent is to get a valid, enforceable patent that will protect your specific invention and the time & effort and research & development dollars you expended to create it and market it. Throughout this process the very first question you should be asking is: What is my invention? You should ask that question many times until, ultimately, you know the answer. If you know what your invention is and how it is different from everything that anyone else is doing now or has ever done, then you can draft a patent application that describes your invention clearly and claim what is actually innovative. Such a patent application description has a high likelihood of resulting in a valid and enforceable patent against which potential infringers can be easily identified. Patent descriptions are intended to be written at a level such that they are understandable by someone of ordinary skill in the art. Generally, ordinary skill is a reference to the skill level of an ordinary practitioner in the art – not of, say, an ordinary person. However, as already noted, skills in the financial serves areas, including insurance, are not, generally, prerequisites for PTO patent examiners. Even financial services or insurance inventors, since many may not actually practice in these areas, may have overall skills that fall below an ordinary practitioner level even though they may excel in the narrower field of their invention. Regardless of the requirement that patent applications be written on the level of ordinary skill in the art, you must be aware that you are, first, writing the patent application to be reviewed by a patent examiner who may have very little background in anything related to your area of practice. Patent examiners are generally fast learners, however. If you include in your description more of the prerequisite knowledge someone of ordinary skill in the art would have acquired through experience (that is, assume nothing), that may make the whole examination process easier. They Have a Patent --- So What? You could, of course, take the ostrich approach and bury your head in the sand figuring that what you don’t know won’t hurt you. But that would be very risky. No business in a competitive industry can really afford not to pay attention to what its competition is doing – whether or not that competition has patents. A patent of value that your business appears to be infringing will probably find you whether you look for it or not. An invention of value that might be useful to your business is probably something you are going to want to know about. So, a patent watch program may be a good way to keep tabs on the new, innovative things going on in your industry and head off potential problems. In effect, a patent watch program could be a very cost effective research and development effort. In a patent watch program, a list of patents and published patent applications that may be of interest is generated periodically, such as quarterly, and distributed to the technical and legal persons in an organization. They give an initial assessment at to whether or not the subject matter of the patents or applications is of interest and whether or not they create an infringement exposure. In traditionally patent intensive industries, such as chemicals, pharma, electronics, software, etc., most technologists know how to read patents and most patent attorneys understand the technology. Thus either a technologist or patent attorney can at least initially identify patents of interest. The situation is more challenging in the financial services industry, however. Very few technologists (e.g. actuaries) have any background in patents and hence may fail to appreciate the significance of a patent or pending application they might read. Similarly, very few patent attorneys have the technological background in financial services to appreciate the significance of what they are reading. Hence it is very important that both technologists and attorneys work closely together to separate the “wheat from the chaff”. Otherwise, important patents may be overlooked and create a patent infringement exposure, or alternatively, unimportant patents may be blown out of proportion and unduly divert company resources. As time goes on, this situation will improve, but in the interim, it’s better to be safe than sorry. Remember, the object of a patent applicant is to file an application that will yield a valid and enforceable patent on clearly defined new technology. If successful, this will make it easy to determine whether or not infringement has occurred. As a potential infringer your object should be to test them on how effectively they did that. |