| Insurance IP

Bulletin

An Information Bulletin on

Intellectual Property activities in the insurance

industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

June 2009 VOL: 2009.3 |

||

| Adobe pdf version | Give us FEEDBACK | ADD ME to e-mail Distribution |

| Printer Friendly version | Ask a QUESTION | REMOVE ME from e-mail Distribution |

| Publisher Contacts

Tom Bakos Consulting, Inc.

Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com

Patent Q & A New Director - USPTOQuestion: Has the Obama administration nominated a new director for the US Patent and Trademark Office? Disclaimer:The answer below is a discussion of typical practices and is not to be construed as legal advice of any kind. Readers are encouraged to consult with qualified counsel to answer their personal legal questions. Answer: Yes. David Kappos. David is currently the VP of patents and trademarks for IBM. Details:On June 18 it was announced that David Kappos has been nominated for the position of Director of the US Patent and Trademark Office. David is currently the VP and Assistant General Counsel for patents and trademarks at IBM. He has also been a strong champion for the Peer to Patent process. Reactions among patent attorneys and agents have been generally favorable, although there is some concern that his agenda will be too closely allied with IBM’s. From a business method

perspective, we view this as overall good news. IBM is one of the largest filers

of business method patents and we are hopeful that Mr. Kappos will

increase the resources in this critical area. THE FIRST OF PCT'S COMPLIMENTARY WEBINAR SERIES.Register

here: http://www.pctcompanies.com/events.html Description: In a case closely watched by the

financial services, software, medical and other industries, the U.S.

Supreme Court will review the In re Bilski ruling that denied a patent for

a method of hedging in commodities trading. In re Bilski largely disavowed the

controversial 1998 State Street Bank decision where the Federal Circuit

opened a floodgate for business method patents. According to its detractors, State

Street had led to the issuance of weak patents and exposed financial

services companies to high-dollar litigation over business method patents.

Now the future of business

method patents and processes is at stake when the Supreme Court hears In

re Bilski during its next term. ·

Case

Background ·

Summary of

Recent Court Cases ·

Speculations

on how the Supreme Court will decide ·

Effect on

valuation of banks, hi-tech firms and start-ups About

the Speakers: Analysis Available Lincoln National Life Insurance Company Alleges Patent Infringement - GMWB Lincoln

National Life Insurance Company has three patents (US

6,611,815; US 7,089,201; and US 7,376,608) covering the methods and

processes used in providing Guaranteed Minimum Withdrawal

Benefits (GMWBs) for variable annuities. Two additional published patent

applications are pending. Lincoln is asserting its patent rights (see story in February 2009 Bulletin) through patent infringement lawsuits against competitors who offer GMWBs. An ex parte re-examination request has been granted by the USPTO with respect to US 7,089,201. Update: Lincoln National recently received a

favorable decision the from Federal District Court in Iowa in its lawsuit

against Transamerica Life.

The Court ruled that the jury had reasonable grounds to hold the

Lincoln patent “was not invalid”.

Transamerica continues

to believe that the patent is invalid and is in the process of appealing

to the Court of Appeals for the Federal Circuit.

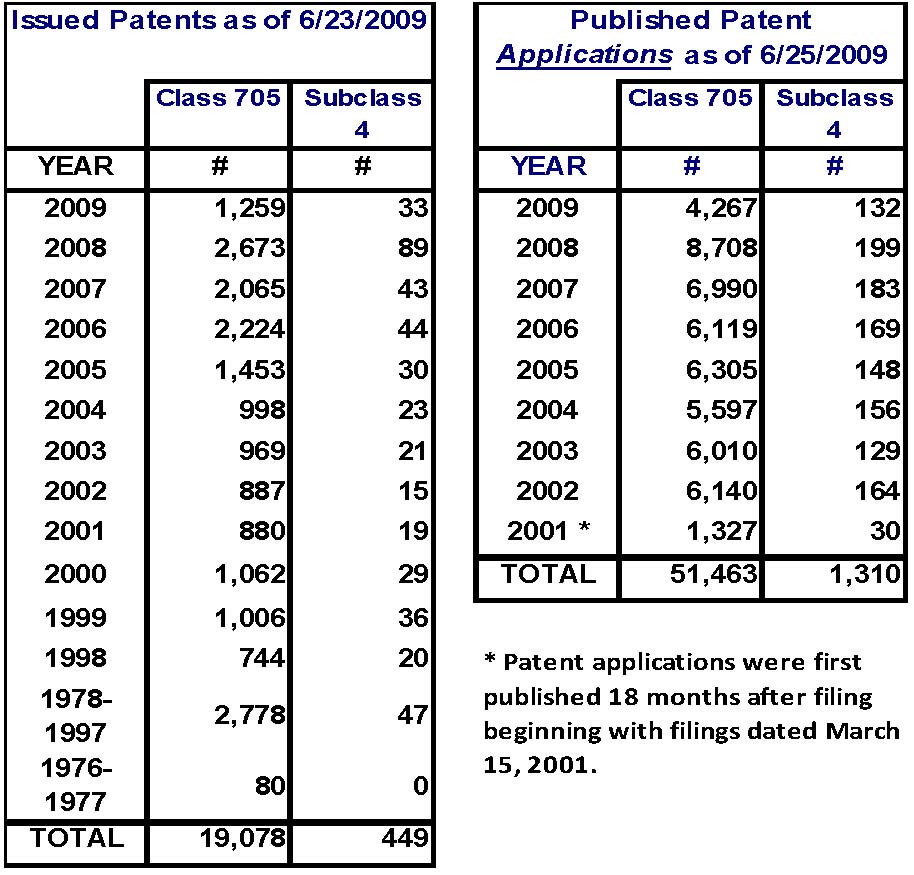

Statistics An Update on Current Patent Activity The table

below provides the latest statistics in overall class 705 and subclass 4.

The data shows issued patents and published patent applications for this

class and subclass.

Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION. Subclass 4 is used to identify claims in class 705 which are related to: Insurance (e.g., computer implemented system or method for writing insurance policy, processing insurance claim, etc.). Issued

Patents In class 705/4, 12 new patents have been issued since 2/24/2009 for a total of 20 in 2009 so far. Patents are issued on Tuesdays each week. Patents are categorized based on their claims. Some of these newly issued patents, therefore, may have only a slight link to insurance based on only one or a small number of the claims therein. The Resources section provides a link to a detailed list of these newly issued patents.Published Patent

Applications

Again, a reminder - Patent applications have been published 18

months after their filing date only since March 15, 2001. Therefore, there are many pending

applications that are not yet published. A conservative estimate would be that

there are, currently, close to 250 new patent applications filed every

18 months in class 705/4. The published patent applications included in the table above are not reduced when applications are issued as patents, rejected, or abandoned. Therefore, the table only gives an indication of the number of patent applications currently pending. Resources Recently published issued U.S. Patents and U.S. Patent Applications with claims in class 705/4. The following are links to web sites which contain information helpful to understanding intellectual property. United States Patent and Trademark Office (USPTO) : Homepage - http://www.uspto.gov/ United States Patent and Trademark Office (USPTO) : Patent Application Information Retrieval - http://portal.uspto.gov/external/portal/pair Free Patents Online - http://www.freepatentsonline.com/

Patent Law and Regulation - http://www.uspto.gov/web/patents/legis.htm Here is how to call the USPTO Inventors Assistance Center:

Mark Nowotarski - Patent Agent services – http://www.marketsandpatents.com/ Tom Bakos, FSA, MAAA - Actuarial services – http://www.BakosEnterprises.com |

Introduction

In this issue’s feature article, The Next Insurance Frontier: Social Networks, we highlight four recent patent applications that show an interest among innovators in the insurance industry on how social networking might be harnessed to solve insurance or risk related problems. In our Patent Q/A we point out that David Kappos has been nominated as the new Director for the USPTO. David has an understanding of business method innovation by virtue of his tenure with IBM. Also, please see the Announcement of a free webinar on In re Bilski and the Supreme Court’s apparent relook at the 1998 State Street Bank decision.

The Statistics section updates the current status of issued Our

mission is to provide our readers with useful information on how

intellectual property in the insurance industry can be and is being

protected – primarily through the use of patents. We will

provide a forum in which insurance IP leaders can share the challenges

they have faced and the solutions they have developed for incorporating

patents into their corporate culture.

Thanks, Tom

Bakos & Mark Nowotarski FEATURE ARTICLE The

Next Insurance Frontier: Social Networks

Co-Editors, Insurance IP Bulletin Social networks, like MySpace, FaceBook, LinkedIn, and Twitter, are going to occupy an increasingly important role in our lives. Recently published patent applications are showing us that significant long term resources are being invested in figuring out how to measure, control and insure a wide variety of risks using social networks (e.g. email, blogs, wikis, auctions). It’s a new frontier and the early pioneers are staking their claims. Here are a few examples. US2008/0228531, “Insurance Optimization Analysis and Longevity Analysis”, by Kenedy et al., describes how social network analysis can identify certain personal attributes that correlate with genetic data common within groups in the social network. With this correlation, statistical analysis can be done to determine the strength of the association between the specified attributes common to a group and specific outcomes related to medical or life risk.

The inventors use their method to help individuals select appropriate types of insurance coverage based on outcome implications of their attribute profiles. Coverages are recommended based on which would be most likely to result in benefit payments. If this invention becomes widespread, it could have an impact on adverse selection. Insurance companies would then have to make their own inventions in order to adapt accordingly. The patent application has been assigned to Expanse Networks, Inc. Expanse Networks is a technology development and licensing firm. Charles Elderling, one of the inventors, indicated in a recent discussion with us that he felt that developing intellectual property in the social network space was one of the best long terms investments his company could make. US 2009/0037470, “Connecting Users Based on Medical Experience”, by John Otto Schmidt, describes the use of social networks by patients suffering from chronic diseases so that they can better manage their health and share their experiences. Specific provision is made for patients to share information about their insurance providers so that they can better manage their relationships with them. In particular, users of the social network can assign grades to their medical insurance providers. The insurance companies, in turn, would be able to search for the grades and comment as they saw fit. Schmidt appears to be an independent inventor with a web site, GenerationMed.com, under development. US2008/0172257, “Health

Insurance Fraud Detection Using Social Network Analytics”, by Bisker et al. describes a method that the inventors

feel could significantly reduce the estimated $200 billion per year in Fraud would be detected by constructing social networks to find linkages between individual participants (typically physicians and other health care providers) in order to establish patterns of behavior which might be indicative of fraud. These observed patterns are then used to more efficiently focus investigative efforts on situations in which fraud is more likely to occur. Results are then fed back into the process to improve the pattern analysis. This application is assigned to IBM. US2007/0136105, “Insuring Decisions within an Organization”, by Huberman, et. al., describes an invention aimed at solving a problem caused by the divergence of employee and employer interests with respect to business project risks. The proposed solution is ”project insurance”. Project insurance pays a benefit if an insured project fails. Through project insurance, employees are encouraged to undertake riskier projects which may have greater payoff potential to an employer rather than sticking to safer projects with less potential. The employee’s interest is aligned with his employer’s by having the employee pay the premium for such insurance protection. The economics of the project insurance structure are established so that the employee is better off financially if the project succeeds than if it fails. The moral risk in this approach is addressed, in part, by the construction of social networks. Social networks based on executives’ email communication patterns are then developed. The social networks serve in an oversight role to monitor and verify that insured employees engage in behavior beneficial to the employer. This application is assigned to Hewlett Packard. The inventions described in these patent applications point the way to how our economy in general and the insurance industry in particular might change in the years ahead. Social networks create a source of information and market influence that may drive that change. The number of new patent applications related to social networks is more than doubling every year. The field is growing rapidly and may get very crowded in the near future. If you have new ideas on social networks, now is the time to get your patent applications on file. |