| Insurance IP

Bulletin

An Information Bulletin on

Intellectual Property activities in the insurance

industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

August 2009 VOL: 2009.4 |

||

| Adobe pdf version | Give us FEEDBACK | ADD ME to e-mail Distribution |

| Ask a QUESTION | REMOVE ME from e-mail Distribution |

| Publisher Contacts

Tom Bakos Consulting, Inc.

Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com

Patent Q & A

|

Introduction

In this issue’s feature article, Mark Nowotarski addresses the cost implications of inefficient patent examination in the U.S. which delays the granting of protections to inventions which have the potential to save American consumers billions of dollars. Mark uses the currently pending Bilski patent application as a prime example. In our Patent Q/A we post reasons to have some confidence that patent examination, at least time wise, is becoming more efficient in the business methods Technology Center.

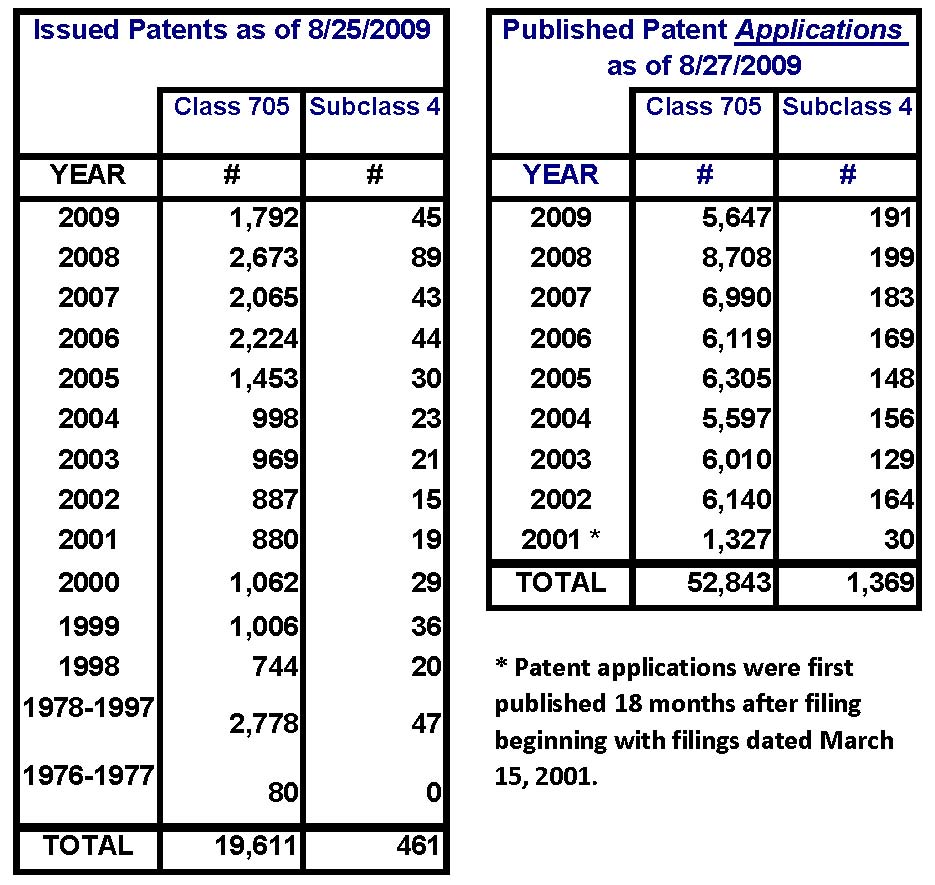

The Statistics section updates the current status of issued Our

mission is to provide our readers with useful information on how

intellectual property in the insurance industry can be and is being

protected – primarily through the use of patents. We will

provide a forum in which insurance IP leaders can share the challenges

they have faced and the solutions they have developed for incorporating

patents into their corporate culture.

Thanks, Tom

Bakos & Mark Nowotarski FEATURE ARTICLE Bernard

Bilski and the Cost to America of a Failed Patent

Examination By: Mark Nowotarski, Patent Agent,Co-Editor, Insurance IP Bulletin

The failure of the examination of Bernard Bilski and Rand Warsaw’s patent application, “Energy Risk Management Method”, has cost American consumers billions of dollars in financial stability over the past decade. The examination was a “failure” because it has dragged on since 1997 with no agreement between the applicant and USPTO as to what, if anything is patentable. In the meantime, the development of a very promising new energy billing process, Fixed Bill pricing, has been hampered by the need to keep the underlying financial innovations secret until if, and when, the inventors can get adequate patent protection. The story of the Bilski/Warsaw invention goes back to the heady days of utility deregulation in the early 90’s. Bernard and Rand were employed by the Equitable Gas Company, a regional energy company in the Pittsburg area. Bernard was the head of the Natural Gas Division.[1] Rand was the director of corporate planning.[2] They had an idea for how to bring stability to the average consumer’s energy bill. They called it “Fixed Bill pricing”. Energy consumption goes up and down year to year largely due to variations in weather. If it’s a cold winter, both consumption and prices go up. If it’s a warm winter, both consumption and prices go down. These fluctuations can cause financial instability in large organizations and genuine hardship among consumers. Bernard and Rand thought they could hedge that risk if they could develop an efficient and reliable way to identify suitable counterparties. These counterparties would be parties willing to bear the burden of consumers’ higher energy costs in cold winters in exchange for a payout from those same consumers in warm winters. If Bernard and Rand could find counterparties, then they could offer consumers a guarantee that their total costs for energy (not just price per gallon) would be the same no matter what the weather did and no matter how much gas (or oil or electricity) they used. They developed their product and evaluated it with a local school district in 1995. They then filed a provisional patent application on April 16, 1996 and a nonprovisional patent application in 1997. That patent application not only described the overall concept, but went into significant detail on how to select suitable counterparties[3] (Monte Carlo simulation based on regional weather patterns). Bernard Bilski and Rand Warsaw then dedicated themselves to bringing their product to market. The left Equitable Gas, formed their own company, WeatherWise USA, and negotiated a license to the patent application[4] from Equitable. They then designed a variety of Fixed Bill products and licensed them to a number of regional energy companies, such as Nicor, Duke Energy, and Wisconsin Public Service. It has been a bumpy road and having to keep the details of their invention a secret because they have been unable obtain adequate patent protection has hurt. When they and their licensees brought the product to market, some regions were hit with a string of unusually warm winters. Consumers were upset because their bills were repeatedly higher than others not on the plan. They complained…loudly… to their State’s Attorneys General (AGs). The AGs in turn, demanded to know the details of the invention to make sure WeatherWise was being honest in its calculations. As Minnesota’s Attorney General, Lori Swanson, put it[5]: “The Commission should not permit the

underlying mechanisms of these programs to remain shrouded in secrecy. If

the programs cannot be operated with transparency, they should not operate

at all.” WeatherWise provided all of

the information they could, but when it came to disclosing the core of

their proprietary methods, a core that could easily be copied when it was

made public, a core which the USPTO and the Courts have been unwilling to

grant a patent on because our 19th century vintage patent

examination process can’t deal with an invention that isn’t “tied to a

particular machine”, they had no choice but to draw the line. As Rand put it in his response to

the Minnesota AG[6]: “To date, we have supplied the OAG

with a complete flow chart of our modeling system along with a high level

overview of our methodology….Our only concern, which has been stressed

from the very beginning of this matter, is that any disclosure of our

methods or modeling information to the public could diminish some or all

of the value of our intellectual property.” This is exactly the conflict that patents are designed to prevent. Patents allow fledgling companies, like WeatherWise, to provide the disclosure necessary for the success of their inventions in the marketplace, without the fear of instant unauthorized copying by their competitors. It is sad and frustrating to see that the examination of the Bilski/Warsaw patent application has devolved to an argument of whether or not they should tie their methods to “a particular machine”. The particular machine that these calculations are carried out on has little to do with the novelty, non-obviousness and most importantly, the usefulness of their invention. It’s a financial product and patent protection for financial products should not be tied to “particular machines” It remains to be seen how the Supreme Court will decide this case. In the meantime, progress in the financial services industry will remain inhibited by the inability of financial innovators to get the timely and efficient patent protection they need.

[1] Joe Mullin, “State AG Attacks Business Method at Center of Key Patent Case”, IP Law & Business, April 1, 2008. [3] Because this patent application was filed in 1997, it wasn’t subject to publication in 18 months. The USPTO has had to keep it a secret. We only know about it now since the inventors provided a copy of it in their filings with the Court of Appeals for the Federal Circuit when they appealed their rejection. [4] A “license to a patent application”, means that when and if a patent issues from a pending patent application, the owner of the patent would not sue the licensee for infringement. |