|

Insurance IP

Bulletin

An Information

Bulletin on Intellectual Property activities

in the insurance industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

August 2010 VOL: 2010.4 |

||

| Adobe pdf version | Give us FEEDBACK | ADD ME to e-mail Distribution |

| Ask a QUESTION | REMOVE ME from e-mail Distribution |

|

Publisher

Contacts

Tom Bakos Consulting,

Inc. Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com Patent Q & A More Insurance Patents Issued than Applied For? Question: It looks like there are a lot more patents issuing in insurance lately. Why is that? Disclaimer:The answer below is a discussion of typical practices and is not to be construed as legal advice of any kind. Readers are encouraged to consult with qualified counsel to answer their personal legal questions.

Answer: The

new director of the patent office, David

Kappos, has made it a priority to clear up the

backlog.

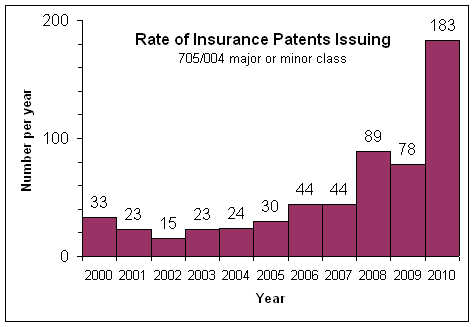

Back in 2004, when we first started publishing the Insurance IP Bulletin, insurance patents were issuing at a rate of only about 24 per year. By 2006 that number nearly doubled to 44 per year. By 2008 it doubled again to about 80 per year. This year, it has already more than doubled again to 183 and may go as high as 250 by the end of the year. Over the long term, what we think is happening is that applicants and examiners are simply getting better at drafting and examining patents on insurance related inventions. Shorter term, the new USPTO director, Dave Kappos, has made it clear that reducing the backlog is a priority and examiners are to be more proactive in reaching agreement with applicants. As he put it, quality does not equal rejection. Examiners are still very tough in insurance, however. We did a spot check of recent office actions since the beginning of the year, and examiners are still only issuing one allowance for every ten rejections. Nonetheless, our impression is that examiners are showing extra effort to make sure that all issues are before the applicants so that agreement can be reached more quickly. The surge in insurance patents in combination with recent willingness of insurance companies to sue to enforce their patents (e.g. Lincoln Financial and Progressive) could make life challenging for companies that have hoped that business method patents would just go away. Any insurance company that has not yet formulated policies and procedures for protecting its own innovations through patents or defending itself from competitors’ patents would do well to put those policies and procedures in place as soon as possible. Statistics An Update on Current Patent Activity

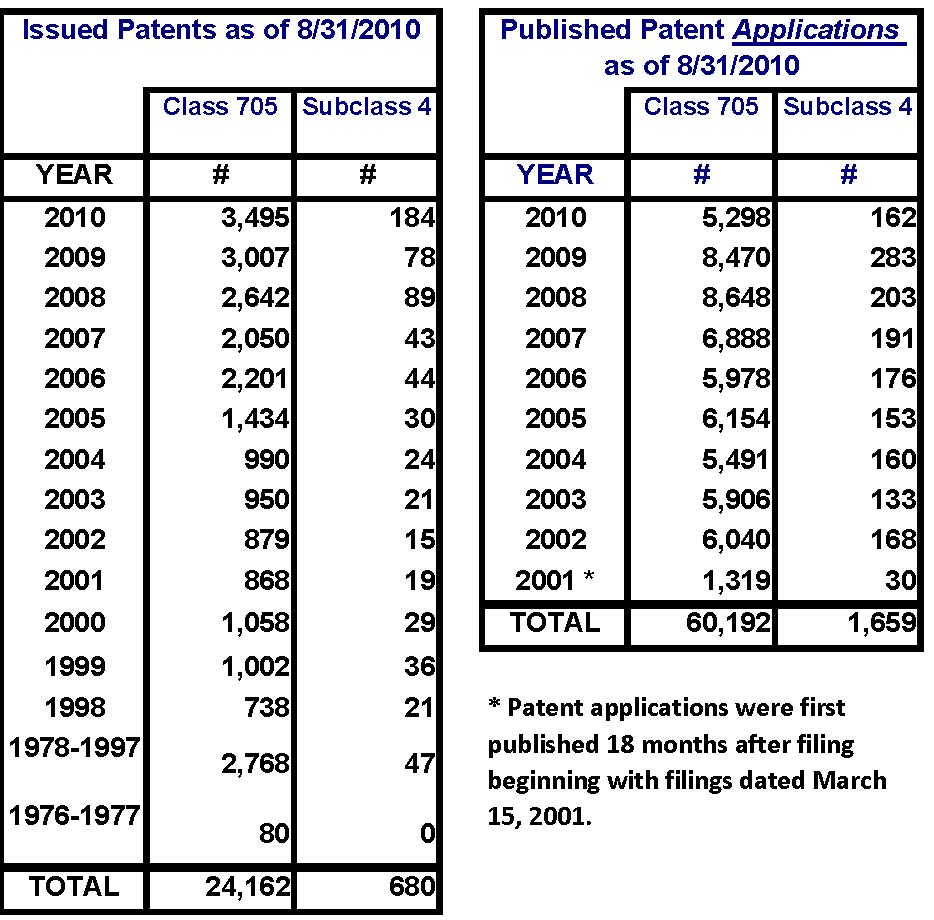

The table

below provides the latest statistics in

overall class 705 and subclass 4. The data

shows issued patents and published patent

applications for this class and

subclass. Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION.

Subclass 4 is used to

identify claims in class 705 which are

related to: Insurance (e.g., computer

implemented system or method for writing

insurance policy, processing insurance

claim, etc.).

Patents are categorized based on their claims. Some of these newly issued patents, therefore, may have only a slight link to insurance based on only one or a small number of the claims therein. The Resources section provides a link to a detailed list of these newly issued patents.

Published Patent

Applications The Resources section provides a link to a detailed list of these newly published patent applications.

The following are links to web sites which contain information helpful to understanding intellectual property. United States Patent and Trademark Office (USPTO) : Homepage - http://www.uspto.gov/ United States Patent and Trademark Office (USPTO) : Patent Application Information Retrieval - http://portal.uspto.gov/external/portal/pair Free Patents Online -http://www.freepatentsonline.com/ US Patent Search - http://www.us-patent-search.com/ World Intellectual Property Organization (WIPO) - http://www.wipo.org/pct/enPatent Law and Regulation - http://www.uspto.gov/web/patents/legis.htm Here is how to call the USPTO Inventors Assistance Center:

The following links will take you to the authors' websites. Mark Nowotarski - Patent Agent services - http://www.marketsandpatents.com/ Tom Bakos, FSA, MAAA - Actuarial services- http://www.BakosEnterprises.com |

Introduction

In this issue’s feature article, TITLE we discuss the underlying rationale which allows patents on human genes and discuss what rights the owner of such a patent has. It is not entirely correct to think a gene patent confers “ownership” of a gene. In our Patent Q/A we consider a question on the topic: The Cost of Maintaining a Patent we discuss the continuing costs associated with ownership of patent rights.

The Statistics section updates the

current status of issued patents and published

patent applications in the insurance class

(i.e. 705/004). We also provide a link to the

Insurance IP Supplement with

more detailed information on recently

published patent applications and issued

patents.

Our mission is to provide our readers

with useful information on how intellectual

property in the insurance industry can be and

is being protected - primarily through

the use of patents. We will provide a

forum in which insurance IP leaders can share

the challenges they have faced and the

solutions they have developed for

incorporating patents into their corporate

culture. Please use the FEEDBACK link to provide us with your comments or suggestions. Use QUESTIONS for any inquiries. To be added to the Insurance IP Bulletin e-mail distribution list, click on ADD ME. To be removed from our distribution list, click on REMOVE ME. Thanks, Tom Bakos & Mark NowotarskiFEATURE ARTICLE Reducing Patent Costs Using Patent Office “PAIR” Data By: Mark Nowotarski - Co-editor, Insurance IP Bulletin

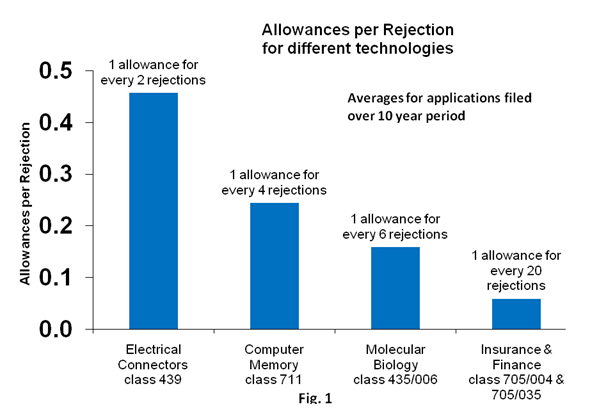

Every patent practitioner wants to effectively represent his or her client’s interests. Every patent examiner wants to effectively represent the public’s interests. Unfortunately, these goals are not always met. This is particularly true in the newer and more controversial fields of patentable subject matter, such as business methods. There is a relatively new source of information, however, that can help both the patent practitioner and patent examiner make substantial improvements in the speed and efficiency of patent examination. This resource is the Patent Application Information and Retrieval System (PAIR). PAIR can be accessed at http://portal.uspto.gov/external/portal/pair. A new PAIR-based metric, the ratio of allowances to rejections, can be tabulated and analyzed quickly to reveal where significant inefficiencies exist in the patent examination process and suggest how fundamental improvements can be made to reduce costs. The ratio of allowances to rejections is the total number of allowances issued by patent examiners for a given portfolio of patent applications divided by the total number of rejections issued by the same examiners for the same portfolio. This data can be tabulated by looking up the PAIR files for each individual application in the portfolio and examining the “transaction history” of the application. The transaction history lists all of the rejections and allowances along with the dates of each. All of the rejections in the portfolio are counted, including those for applications that have been abandoned or are still pending. Each one of these rejections could have been an allowance presuming that the applicant was making a genuine effort to advance prosecution when it last corresponded with the patent office. Patent applications in all technologies over the past 10 years have had an average allowance to rejection ratio of about 0.3. An allowance to rejection ratio of 0.3 corresponds to about one allowance for every three rejections. First office actions have a somewhat lower allowance ratio than the average. This is consistent with the common knowledge that applicants will take a more aggressive position with the claims that they file relative to the amended claims they present after a rejection. The allowance to rejection ratio for second and higher rejections remains relatively constant. This has the somewhat disturbing implication that at least on average, practitioners and examiners are not getting any better at understanding each other as prosecution progresses. If practitioners and examiners were learning from each rejection – response interchange, then the allowance ratio would increase for each succeeding office action. Figure 1 illustrates that allowance to rejection ratios are very different for different technologies.

These ratios were generated by randomly selecting samples of published applications within a particular class or class/subclass. The file wrappers of the applications were then reviewed in PAIR. The samples covered about 10 years of filings. Traditional fields of patentable technology, such as electrical connectors, have high allowance to rejection ratios. Newer fields, such as insurance and finance have very low allowance to rejection ratios. Allowance to rejection ratios translate directly to prosecution costs. Electrical Connectors have an allowance ratio of 0.45. This corresponds to about 2 rejections per allowance. If each response to a rejection costs about $2,000 in legal fees, then the prosecution cost per patent in the field of electrical connectors is about $4,000. At the other extreme, insurance and finance applications have an allowance to rejection ratio of only 0.05. This corresponds to about 20 rejections per allowance. The prosecution costs for these applications are about $40,000 per issued patent. The allowance to rejection ratio in insurance & finance is very sensitive to the law firm that is handling a given portfolio of applications. Figure 2 shows the allowance ratios for three different law firms, each preparing and prosecuting applications over a five to seven year period for the same major financial corporation. This corporation has several hundred applications pending and, until recently, each law firm handled a comparable share.

Prosecution costs for these firms range from $16,000 per issued patent (Law Firm A) to $120,000 per issued patent (Law Firm C). While reviewing the file wrappers in PAIR, we discovered that this financial company recently transferred all of the cases filed by Law Firms B and C to Law Firm A. Figure 2, therefore, only shows the allowance ratios for each law firm prior to the transfer. After the transfer, the allowance ratio for the cases that Law Firm A took over then increased to the same level as the cases originally prepared and filed by Law firm A. It’s not clear why there is such a large difference in examination efficiency in business methods between equally experienced and equally competent law firms. When we looked at each firms overall track record for all technologies that they handle, they all had about the same allowance to rejection ratio. It’s possible that some firms are playing strictly by the book and responding to rejections in a standard manner. This is unlikely to be successful given the very difficult nature of examining business method cases and the constantly shifting criteria for patentability as expressed in different court cases. Other firms may be spending more time understanding the nuances of business method patent examination and hence may be more successful in properly responding to examiner’s rejections. Whatever the causes, however, properly identifying them and responding to them could lead to substantially reduced prosecution costs.

There is a tremendous wealth of

information in the USPTO’s patent

application information and retrieval

system. New statistical measures of

patent examination efficiency, such as the

allowance to rejection ratio, can now be

calculated and analyzed. Practitioners

that take advantage of this data will be in a

better position to serve their clients

effectively.

|