| Publisher Contacts

Meeting

Announcement

A session on

new patented or patent pending retirement income products has been added

to the upcoming RIIA meeting, Managing

Retirement Income Conference, to be held at the Doral Resort Golf

Resort and Spa in Miami Florida, February 13 – 18, 2008. Mark Nowotarski will be hosting a

panel of inventors and IP attorneys who will discuss the challenges and

successes they’ve had in bringing new retirement income inventions to

market. Q&A will

follow.

The panelists

include:

- Chuck

Robinson, SVP Investment Products & Services, Northwestern Mutual

Life Insurance Company

- John

Bevacqua, Principal Deloitte Consulting

- Matt

Schoen, Managing Principal, Private Placement Insurance Products,

LLC

- Matthew Reece, Counsel Pepe & Hazard LLP.

Information

and Registration can be found at:

http://www.iirusa.com/retirement/eventhome/35279.xml

To

obtain a “moderator referral” discount, please contact Mark Nowotarski at

(203) 975-7678.

Patent Q

& A

Patent Reform Act of

2007

Question:

What’s happening with the Patent Reform Act of

2007?

Disclaimer:The answer below is a discussion of typical

practices and is not to be construed as legal advice of any kind. Readers are

encouraged to consult with qualified counsel to answer their personal legal

questions.

Answer: Well, not much right now but there are some

significant changes proposed and it is worth paying attention to.

Details: Here’s what’s happened. The Patent

Reform Act of 2007 was introduced into the House (H.R. 1908) and the

Senate (S.1145) on April 18, 2007. The House version passed on September

7, 2007. The Senate version, which was identical when introduced, is

awaiting action. The Senate bill has been reported out of the Senate

Judiciary Committee with some changes. Further action in the Senate is

expected in early January, 2008.

Both the House and Senate versions have been amended identically to

make "tax planning inventions" unpatentable subject matter.

See the Senate version of this amendment at: S

2369.

Per the amendment a "tax planning invention" means " a plan, strategy,

technique, scheme, process, or system that is designed to reduce,

minimize, avoid, or defer, or has, when implemented, the effect of

reducing, minimizing, avoiding, or deferring, a taxpayer’s tax liability

…" The amendment specifically excludes tax preparation software or other

tools used solely to prepare tax returns.

Of course, the definition, even though it may seem precise, is broad

enough under some interpretations to include any process involving

insurance since life and annuity insurance products enjoy a tax deferral

advantage. It is expected that some work will need to be done on the

language to focus in on only the SOGRAT type patents (see the feature

article) which are, apparently, the intended target of this amendment.

In addition, the Internal Revenue Service has published

regulations that will add "patented transactions" to the category of

reportable transactions. The definition of a "patented transaction" is "a

transaction for which a taxpayer pays (directly or indirectly) a fee in

any amount to a patent holder or the patent holder’s agent for the legal

right to use a tax planning method that the taxpayer knows or has reason

to know is the subject of the patent." This regulation also specifically

excludes patented tax preparation software. It may, however, be

interpreted broadly enough to include patented insurance design concepts

which only incidentally have the effect of reducing or deferring

taxes because they inherit the tax deferral advantage enjoyed by all life

and annuity insurance products.

See the June

15, 2007 issue of the Insurance IP Bulletin

for a summary of other patent reforms in the Patent Reform Act of

2007.

Statistics

An Update

on Current Patent Activity

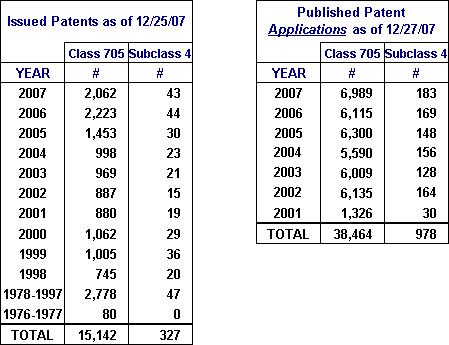

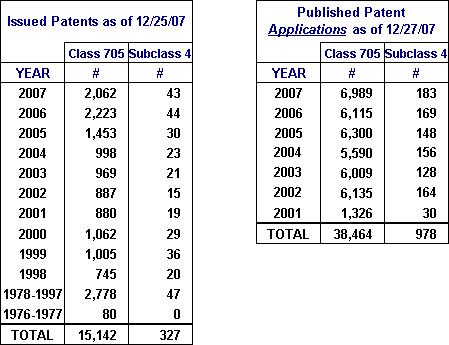

The table below provides the latest statistics in overall class 705

and subclass 4. The data shows issued patents and published patent

applications for this class and subclass.

Class 705 is defined as: DATA PROCESSING: FINANCIAL,

BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION.

Subclass 4 is

used to identify claims in class 705 which are related to:

Insurance (e.g., computer implemented system or method for

writing insurance policy, processing insurance claim,

etc.).

Issued

Patents

A total of 43 patents have been issued in class 705/4 in 2007-

only one short of the 44 issued during 2006.

Patents are categorized based on their claims. Some of these newly

issued patents, therefore, may have only a slight link to insurance based

on only one or a small number of the claims therein.

The

Resources section provides a link to a

detailed list of these newly issued patents.

Published Patent

Applications

A total of 183 patent applications were published during 2007 class

705/4 indicating a continued high level of patent activity in the

insurance industry.

The Resources section provides a link to a detailed list of these newly

published patent applications.

Again, a reminder -

Patent applications have been published 18

months after their filing date only since March 15, 2001. Therefore, there are many pending

applications that are not yet published. A conservative estimate would be that

there are, currently, close to 250 new patent applications filed every

18 months in class 705/4.

The published patent applications included

in the table above are not reduced when applications are issued as

patents, rejected, or abandoned.

Therefore, the table only gives an indication of the number of

patent applications currently pending.

Resources

Recently published issued

U.S. Patents and U.S. Patent Applications with claims in class 705/4.

The following are links to web sites

which contain information helpful to understanding intellectual

property.

United States Patent and Trademark Office

(USPTO) :

Homepage -

http://www.uspto.gov/

United States Patent and

Trademark Office (USPTO) : Patent

Application Information Retrieval -

http://portal.uspto.gov/external/portal/pair

Free Patents Online -

http://www.freepatentsonline.com/

US Patent Search -

http://www.us-patent-search.com/

World Intellectual Property

Organization (WIPO) - http://www.wipo.org/pct/en

Patent Law and

Regulation -

http://www.uspto.gov/web/patents/legis.htm

Here is how to call the USPTO Inventors Assistance Center:

- Dial the USPTO’s main

number, 1 (800) 786-9199.

- At the first prompt

press 2.

- At the second prompt

press 4.

- You will then be

connected to an operator.

- Ask to be connected to

the Inventor’s Assistance Center.

- You will then listen to

a prerecorded message before being connected to a person who can help

you.

The

following links will take you to the authors’ websites

Mark Nowotarski - Patent Agent services – http://www.marketsandpatents.com/

Tom Bakos, FSA, MAAA -

Actuarial services – http://www.BakosEnterprises.com

|

Introduction

By publishing a little later

than our usual schedule we are able to close out 2007 with a complete 2007 issued patents and published applications table in

the Statistics section. The editors were also able to enjoy a year-end holiday

with a little less work and worry.

In this issue’s feature article, Designing

Around a Threatening Patent ,

Mark Nowotarski discusses how one might address a new patent which seems

to threaten their own business activity. However, those of our readers who

are considering protecting an invention they have made with a patent may

learn something from the article about how to draft a stronger patent.

In our Patent Q/A we address a question regarding

the current status of the Patent Reform Act of 2007. So far, in Congress

there has been a lot of talk but little action. The bill has passed the

House and is now being considered by the Senate. The House bill has a ban

on "tax patents". The Senate bill has the same language. This ban could

significantly impact insurance patents since many insurance inventions

have positive tax consequences. Early 2008 may show progress on the Patent

Reform Act front. We will keep you posted.

The Statistics section updates the current status of

issued US patents and published patent applications in the insurance class

(i.e. 705/4). We also provide a link to the Insurance IP

Supplement with more detailed

information on recently published patent applications and issued

patents.

Our mission

is to provide our readers with useful information on how

intellectual property in the insurance industry can be and is

being protected – primarily through the use of patents. We

will provide a forum in which insurance IP leaders can share the

challenges they have faced and the solutions they have developed

for incorporating patents into their corporate culture.

Please use the FEEDBACK link above to provide

us with your comments or suggestions. Use QUESTIONS for any inquiries. To

be added to the Insurance IP Bulletin e-mail distribution list, click on

ADD ME. To be removed from our distribution list, click on REMOVE

ME.

Thanks,

Tom Bakos & Mark Nowotarski

FEATURE ARTICLE

Designing Around a Threatening

Patent

(or,

How I learned to Stop Worrying and Love the SOGRAT patent)[1]

By: Mark Nowotarski

An important skill in an intellectual property based

business is the ability to “design around” a threatening patent. A design around is a modification

made to a patented invention so that most, if not all, of the benefits of

the original invention are preserved, but the modification doesn’t

infringe the claims of the issued patent.

The steps to a design around include:

- Read the

existing patent.

- Analyze the

claims to identify steps of each independent claim that can potentially

be eliminated or changed.

- Propose a way

to eliminate or change said steps to create a new, non-infringing

invention.

- Verify that the

non-infringing invention does not, in fact, infringe the existing

patent.

- File a patent

application on the new invention.

To

illustrate how this process can be applied to a real world example of an

insurance patent, we will show how the steps could be applied to the

infamous SOGRAT®

patent, US patent 6,567,790, “Stock Option Grantor Retained Annuity

Trust”. The SOGRAT patent

has recently become notorious in the estate planning profession due

largely to the fact that the owner of the patent, Wealth Transfer Group

LLC, sued an individual, John W.

Rowe, former CEO of Aetna, for infringing it. This lawsuit sent shock waves

through the tax planning community since it appeared that patents could be

used to block tax payers from minimizing their taxes and tax planners from

giving the best possible tax savings advice to their clients. As a result, a number of powerful

professional organizations, including the American Institute of Certified

Public Accountants and the American Bar Association, have effectively

lobbied Congress and the IRS to either ban patents like this, exempt tax

planning professionals from the liability of infringing them, or heavily

regulate their licensing. The

SOGRAT patent has been characterized as a tax

patent (or “tax planning patent”, or “tax strategy patent”). We need to be concerned about it,

however, since it involves a novel use of annuities and life insurance

policies. Hence it can also

be considered an insurance patent.

Step 1: Read the

patent

The specification of the SOGRAT patent

discloses a method for passing stock options on to heirs using an

annuity. This method has the

potential for being tax efficient based on the IRS’s current

interpretation of gift tax regulations. The basic idea is that a donor

funds a Grantor

Retained Annuity Trust (or GRAT) with a combination of cash and stock

options. The donor puts

enough cash into the trust so that the initial annuity payments can be

made with the cash and the stock options can remain in the trust for as

long as possible. When the

cash is used up, the remaining annuity payments are made with a portion of

the stock options. Hopefully

the stock options will have increased in value so that when the trust

matures, there are stock options remaining which can be passed onto the

beneficiary. The beneficiary

is a family member of the donor.

If the donor dies prior to the maturity date of the trust, then the

assets are passed on to the beneficiary at that time.

The annuity payments are selected when

the fund is established so that the cumulative value of said payments is

equal to the calculated value of the stock options at trust inception plus

the cash contribution at trust inception plus the anticipated earnings of

the trust based on an assumed interest rate. The assumed interest rate is set

equal to the federal midterm rate plus ˝% at the time the fund is

established. Thus, from the

standpoint of the IRS, the future value of the trust at maturity is

zero. The gift tax of the

trust therefore is also zero.

If the stock options in the SOGRAT appreciate faster than the

assumed interest rate, then the assets of the trust will be positive at

the end of the term and these are passed on to the beneficiary without

being assessed a gift tax.

In order to determine the number of

stock options that must be paid to the donor at each annuity payment, the

stock options are valued “as each annuity payment is made”.

Step 2: Analyze the claims to

identify steps of each independent claim that can potentially be

eliminated or changed.

A patent covers only what is in the

claims. In order to infringe a claim the

infringer must (if it is a method claim) perform all of the steps in the

claim. If just one step is

left out, the claim is not infringed. If none of the claims are

infringed then the patent is not infringed.

There are two types of claims in a

patent, independent and dependent.

Independent claims stand on their own. Dependent claims “depend” upon

earlier independent claims.

Each dependent claim refers to at least one independent claim and

incorporates all of the independent claim’s steps into it.

In designing around a patent, you only

have to focus on the independent claims. If you don’t infringe any of the

independent claims, you won’t infringe any of the dependent claims.

Claim 1 of the SOGRAT patent is an

independent claim. It

reads:

- A method for

minimizing transfer tax liability of a grantor for the transfer of the

value of nonqualified stock options to a family member grantee, the

stock options having a stated exercise price and a stated period of

exercise, the method performed at least in part within a signal

processing device and comprising:

- establishing

a Grantor Retained Annuity Trust (GRAT);

- funding said

GRAT with assets comprising stock options, the stock options having a

determined value at the time the transfer is made;

- setting a

term for said GRAT and a schedule and amount of annuity payments to be

made from said GRAT; and

- performing a

valuation of the stock options as each annuity payment is made and

determining the number of stock options to include in the annuity

payment.

In order to design around this claim,

one needs to find a way to either eliminate one of these steps or

substitute a different step for one of these steps without unduly

sacrificing the benefits of the invention. The critical skills are both

technical (How can we do this?) and legal (How can we be sure we did

this?).

It is essential to determine exactly

what each word and phrase in a claim means in order to design around

it. An inventor may give a

word or phrase a particular meanings in the specification

of the patent. If no meaning

is given in the specification, then courts will give a word or phrase the

meaning that is commonly used among professionals of ordinary skill in the

art of the invention.

Consider step (d) of claim 1:

d.

performing a valuation of the stock options as each

annuity payment is made and determining the number of stock options to

include in the annuity payment. (emphasis added)

What does the phrase “as each annuity

payment is made” mean? It’s

not defined or used in the specification so that means we have to rely on

the definition of those of ordinary skill in the art. An informal poll among members of

the AICPA

indicated that, at least for some accountants specializing in estate tax

planning, “as each annuity payment is made”, means up to two months prior

to said annuity payment being made.

For the sake of this discussion, let’s accept that definition.

Step 3: Propose a way to eliminate or

change said steps to create a new non-infringing

invention.

Is there an acceptable or even

beneficial way to manage a SOGRAT that it doesn’t involve performing a

valuation of the stock options “as each annuity payment is made”? We leave that question to the

inventiveness and creativity of our readers. But if someone does invent a way

and if that way does not unduly sacrifice the benefits of a SOGRAT, then a

new, potentially non infringing design around would have been made.

Let’s assume that a new method for

managing a SOGRAT has been invented and doesn’t require step (d). If this new method is practical,

and if the new method stands up to legal scrutiny, then at least claim 1

of the SOGRAT patent will have been designed around. This step must then be repeated

for all of the other independent claims of the patent.

Fortunately for this example, all of

the independent claims of the SOGRAT patent have the equivalent of step

(d). If the design around for

step (d) works for claim 1, then the design around for step (d) may work

for the other independent claims as well.

Step 4: Verify that the

non-infringing invention does not, in fact, infringe the

patent.

In order to determine if the new

invention doesn’t infringe the existing claims of a given patent, it’s

necessary to get a legal “infringement opinion”. An experienced patent attorney

is presented with the proposed new invention and a copy of the patent that

is being designed around. The

attorney is then asked, “Does this new invention infringe the

patent?” The patent attorney

will then study both the invention and the patent and supply an

infringement opinion.

If the infringement opinion says “yes, it does infringe” then it’s

back to the drawing board. If

the opinion says “no, it doesn’t infringe”, then it’s clear sailing.

Chances are, however, the infringement opinion will say

“it depends”. The opinion

will lay out certain interpretations of the claims that could “read on”

the new invention (and hence infringe the patent). It will also give an assessment of

the likelihood of a jury in a patent trial accepting these interpretations

and may discuss counter arguments that could be presented to show that the

new invention does not infringe.

It is then up to the appropriate

business manager to make the decision of whether or not the risk of

provoking a patent infringement lawsuit is worth the reward of bringing

the new, presumably non infringing invention to market. For example, if the design around

relied on valuations being done three months before each annuity payment

is made instead of up to two months, then the likelihood of provoking a

patent infringement lawsuit might still be high and the risk might not be

worth the reward. If, on the

other hand, the design around relied on valuations being done more than a

year before each annuity payment is made then the likelihood of provoking

a patent infringement lawsuit could be much lower and the risk might then

be worth the reward.

Step 5: File a patent

application on the new invention.

If the design around is a new

invention in and of itself, then it should be considered for patent

protection. It’s quite

possible that the design around has important benefits that the earlier

patented invention does not have.

These benefits could lead to an even larger market for the design

around than for the earlier invention. With a patent in hand, the

inventor can protect the new intellectual property he or she has

created.

If the design around still might be

considered to infringe the threatening patent, then having a patent on it

may allow both parties to cross license their patents to each other. They then can bring their

respective products to market to the exclusion of other competitors. Thomas Edison did this with his

light bulb patent. Both he

and his arch rival Joseph Swan were locked in a fierce patent battle over

who invented the light bulb.

Edison’s original patent covered a method for making

the light bulb filament.

Swan’s original patent, filed only five months later, covered how

to make an air tight seal around the wires that went into the bulb. Both inventions were important for

making practical light bulbs.

Eventually Edison and Swan settled their dispute by cross-licensing

their respective patents to each other. They then formed a joint venture

to bring their light bulbs to market. If either one hadn’t patented his

invention, they might not have been able to form the joint venture.

Conclusion:

The ability to design around a patent

is a critical skill in any industry where patented inventions are made,

used or sold. A design around

is performed by reading the threatening patent, analyzing the claims,

finding one or more steps of each claim that can be eliminated or

modified, inventing an alternative step, getting a legal opinion to make

sure that the new alternative does not infringe, and, optionally, filing a

patent application on the new alternative. Even patents as seemingly

formidable as the SOGRAT patent may be vulnerable to a design around. Design arounds can lead to better

inventions, the avoidance of future lawsuits and the establishment of very

profitable cross licenses or joint ventures.

|