|

Insurance IP

Bulletin

An Information

Bulletin on Intellectual Property activities

in the insurance industry

A Publication of - Tom Bakos Consulting, Inc. and Markets, Patents and Alliances, LLC |

April 2012

VOL: 2012.2 |

||

| Adobe pdf version | Give us FEEDBACK | ADD ME to e-mail Distribution |

| Ask a QUESTION | REMOVE ME from e-mail Distribution |

|

Publisher Contacts

Tom Bakos Consulting, Inc.

Tom Bakos: (970) 626-3049 tbakos@BakosEnterprises.com Markets, Patents and Alliances, LLC Mark Nowotarski: (203) 975-7678 MNowotarski@MarketsandPatents.com

Patent Q & A New Insurance IP - Summary Question: In what product areas is new insurance IP being established? Disclaimer: The answer below is a discussion of typical practices and is not to be construed as legal advice of any kind. Readers are encouraged to consult with qualified counsel to answer their personal legal questions. Answer

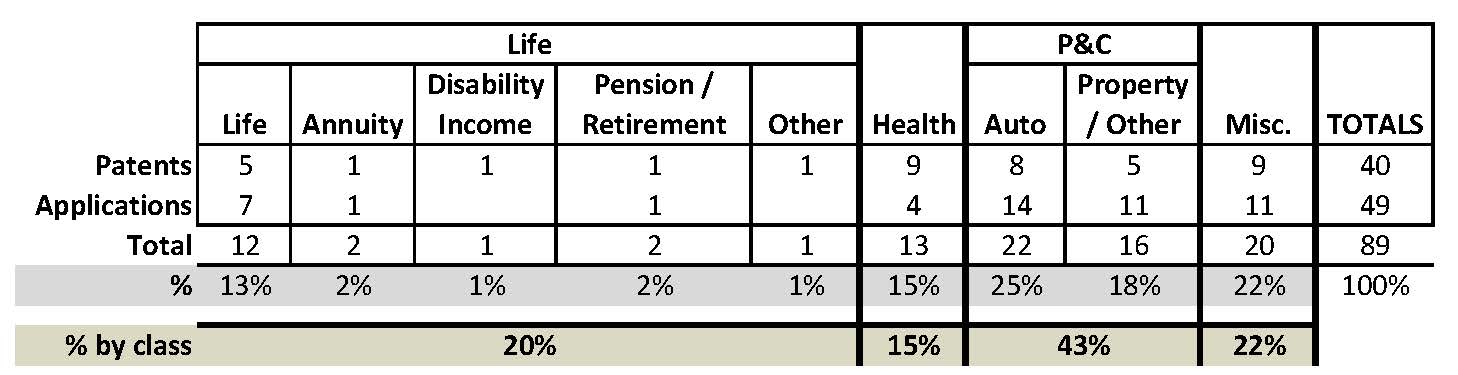

(from Tom Bakos): Based on an evaluation of the last two months' issued patents and published patent applications, it looks like invention in the Property & Casualty lines of business predominate.

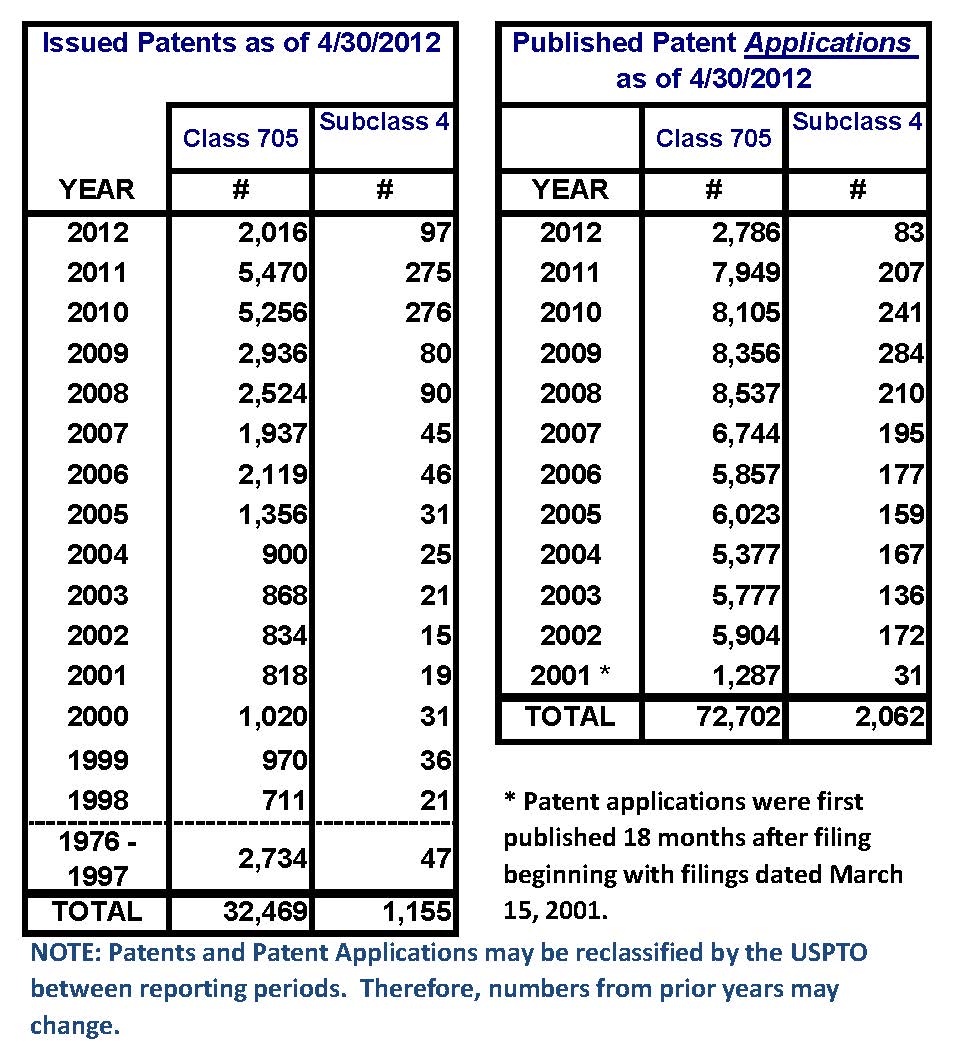

The "Misc." column at the far left is a category for IP which is not easily classified by the traditional life or P&C categories. However, this IP is usually more related to P&C than to life. For example, this category includes an invention to insure the value of a portfolio of securities. The "Health" category can be in either life or P&C as health insurance overlaps those two broad categories. So, overall, P&C innovation dominates with auto insurance innovation the largest segment of the P&C category - equal to 25% of all innovation in the insurance over the last two months. The high volume of IP in the Misc. category indicates that innovation is not just related to improving current insurance processes but to developing entirely new categories of insurance. Statistics An Update on Current Patent Activity The table below

provides the latest statistics in overall class

705 and subclass 4. The data shows issued

patents and published patent applications for

this class and subclass.

Class 705 is defined as: DATA PROCESSING: FINANCIAL, BUSINESS PRACTICE, MANAGEMENT, OR COST/PRICE DETERMINATION. Subclass 4 is used to identify

claims in class 705 which are related to:

Insurance (e.g., computer implemented system

or method for writing insurance policy,

processing insurance claim, etc.).

Issued Patents Note also, that because the USPTO reclassifies patents and patent applications from time to time, the numbers for prior years or months may change. Patents are categorized based on their claims. Some of these newly issued patents, therefore, may have only a slight link to insurance based on only one or a small number of the claims therein. The Resources section provides a link to a

detailed list of these newly issued

patents.

Published Patent

Applications The Resources section provides a link to a detailed list of these newly published patent applications.

United States Patent and Trademark Office (USPTO) : Homepage - http://www.uspto.gov/ United States Patent and Trademark Office (USPTO):Patent Application Information Retrieval - http://portal.uspto.gov/external/portal/pair Free Patents Online-http://www.freepatentsonline.com/ US Patent Search - http://www.us-patent-search.com/ World Intellectual Property Organization (WIPO) - http://www.wipo.org/pct/en Patent Law and Regulation - http://www.uspto.gov/web/patents/legis.htm Here is how to call the USPTO Inventors Assistance Center:

The following links will take you to the authors' websites. Mark Nowotarski - Patent Agent services - http://www.marketsandpatents.com/ Tom Bakos, FSA, MAAA - Actuarial services- http://www.BakosEnterprises.com |

Introduction

In this issue Mark points out in: Getting a Loan with Your Patents , that patents and patent applications may have value that can be used to collateralize a business loan. Such loans may provide valuable cash flow to start ups or established corporations in the development of products or services enabled by the IP. In the Patent Q/A Tom provides a summary of the prevalent subject matter areas in which new insurance (i.e., class 705/4) innovation is being established in answer to the question: In what product areas is new insurance IP being established? The Statistics section updates the current status of issued US patents and published patent applications in the insurance class (i.e. 705/004). We also provide a link to the Insurance IP Supplement with more detailed information on recently published patent applications and issued patents.

Our mission is to provide our

readers with useful information on how

intellectual property in the insurance industry

can be and is being protected - primarily

through the use of patents. We will

provide a forum in which insurance IP leaders

can share the challenges they have faced and

the solutions they have developed for

incorporating patents into their corporate

culture. Please use the FEEDBACK link to provide us with your comments or suggestions. Use QUESTIONS for any inquiries. To be added to the Insurance IP Bulletin e-mail distribution list, click on ADD ME. To be removed from our distribution list, click on REMOVE ME. Thanks,Tom Bakos & Mark

Nowotarski FEATURE ARTICLE Getting a Loan with Your Patents By: Mark Nowotarski, Markets, Patents & Alliances LLC - co-editor, Insurance IP Bulletin Did you know you could secure a business loan with your patent(s)? Neither did I until I started reviewing the assignment records at the USPTO. Assignments indicate who owns an issued patent or pending patent application. These are registered with the USPTO and available for public inspection. There is a special type of assignment called a "security agreement". A security agreement indicates that a patent owner has used its patent(s) as collateral for a loan. A security agreement says that the lender will get ownership of a patent if the current patent owner defaults on the loan. The security agreement also restricts what the patent owner can do with its patent so that the value of the patent is preserved. A patent owner might be obligated, for example, to pay the maintenance fees for an issued patent. This will insure that the patent continues to be in force during the term of the loan. If the loan is paid off, the security agreement is released. If the loan goes into default, the ownership of the patent is turned over to the lender. A formal patent valuation is important for determining how much of a loan a patent portfolio can support. There are consulting firms that specialize in patent valuations, like GTT Group. I spoke with Dan Buri, Director of Asset Services for GTT Group, about the overall patent valuation process. He indicated that lending is often based on a total company valuation with patents supporting elements of the company's value. Key drivers of patent value are current and forecasted demand for the patented invention, known Evidence of Use in the market, and the remaining life left on the patent. Patent valuation, however, is dependent upon market circumstances and the purpose of the valuation. For instance, a company valuing a patent from an internal defensive perspective will likely approach the overall patent portfolio value differently than a company considering the patent portfolio's offensive market value. Security agreements have been used for issued and pending patents in the insurance industry. A random sample of 100 pending insurance patent applications, for example, showed that 6 had security agreements. The companies getting these security agreements ranged from startups to Fortune 500 companies. Startups often need bridge loans to cover the gaps between successive rounds of funding. They use their issued patents and pending patent applications as collateral for the loans. Fortune 500 companies can face difficult times as their marketplaces change. They too may need to use their patents as collateral for financing. You can see the terms of the financing in a company's SEC filings if the company is publicly traded. The lenders providing patent-backed loans tend to be banks. Equity investors and even angel investors also provide loans backed by patents. The banks tend to be those that focus on startups and emerging companies. Comerica Bank and Silicon Valley bank, for example, actively market their services to startups. The also participate as co-investors in venture capital rounds. Comerica has 8,128 security agreements in place. Silicon Valley Bank has 16,124 security agreements in place. Once a loan is paid off, the bank or other lender releases the security agreement and the assignee has unencumbered ownership again. Records of security agreement releases are also found in the UPSTO's assignment data base. If a loan is defaulted on, then the lender becomes the proud owner of the secured patent applications or issued patents. The lender may sell off the patents or actively enforce the patents if there is significant infringement. There are companies that specialize in taking over repossessed patents for enforcement purposes. These are the much beloved "patent trolls" we hear about in the news. No one likes a patent troll, but their activity supports the value of patents and that, in turn, makes patents suitable for collateral for loans. Without this support, many more startups and even Fortune 500 corporations might be failing since they wouldn't have the patent collateral necessary to secure their loans. In summary, patent(s) can be used to secure loans. These loans can be important sources of cash flow for emerging startups as well as struggling major corporations. Establishing a value for a portfolio of patents is important for securing the loan. Large and growing markets for the inventions, active infringement of the issued patents, and significant years of remaining patent life are all important factors for demonstrating the full value of your patents to a lender. Patent trolls support this value by enforcing the patents taken over by lenders when the loans go into default. This helps retain patent based lending as an important source of business financing. (For more information on using patents as loan collateral, contact Mark Nowotarski at 203 975 7678 or www.marketsandpatents.com) |